Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc.

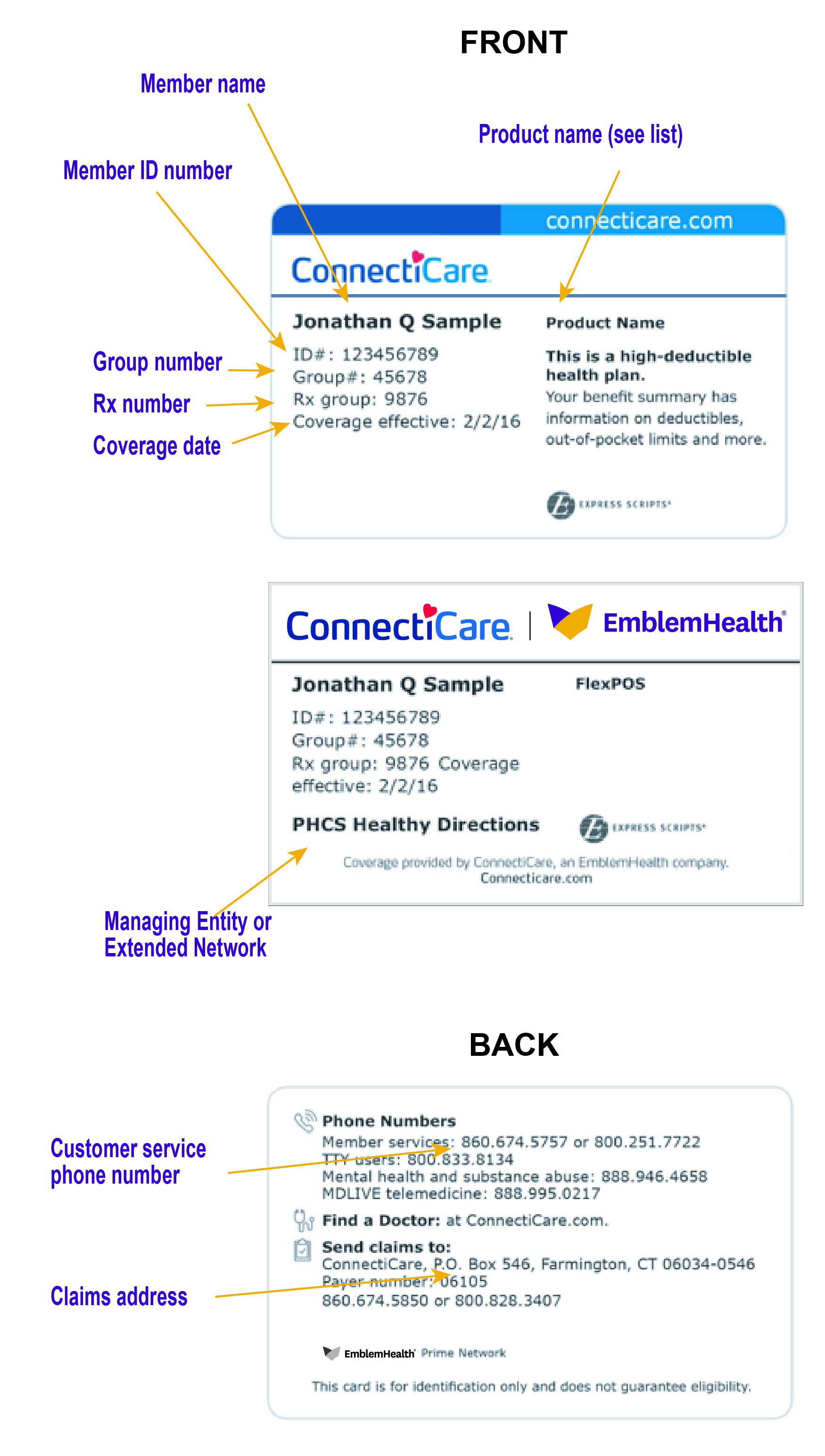

Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. Many insurance cards list the specific amount that you are responsible for paying for the medical services you are receiving. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company .

Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card.

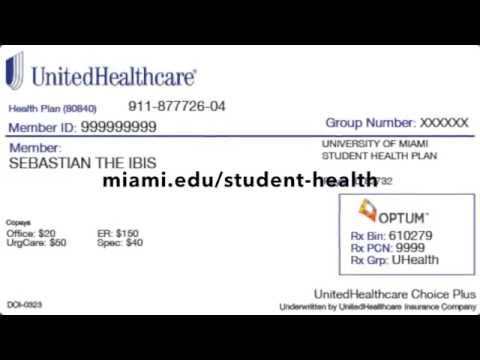

This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip. A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more.

Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services. These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine.

Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy.

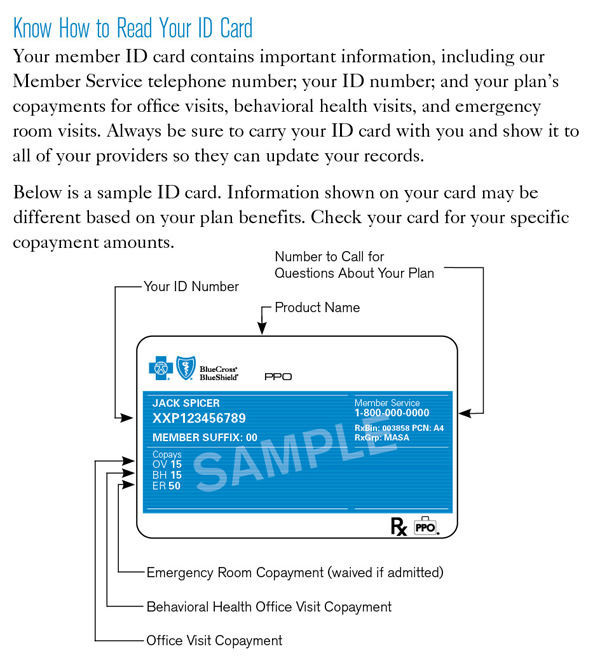

All health insurance cards should have a policy number. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card.

If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. The first is for your in-network providers, while the second is for out-of-network health care providers. Other plans may have varying costs for different services as well. Your health insurance company might pay for some or all the cost of prescription medicines.

If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. You might see another list with 2 different percent amounts.

Some health insurance plans include special savings accounts for health-related expenses. The key to getting the most out of your savings account is knowing which type you have and how to use it. Check the information your employer gave you to see whether you have a health savings account , health reimbursement account or flexible spending account .

Then, use the links below to learn more and find important forms and resources. Create a HealthPartners account to get the most from your health insurance plan. You only need to know your member ID number and your birth date.

Once you create an account, you can view your benefits, track your medical spending, compare the cost of medical procedures and find ways to lower the cost of care. The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. Your health insurance policy allows you to enjoy medical services offered by providers included in Harel's agreement, at no cost.

The back of the member ID card may include phone numbers to connect with customer service, speak with a nurse and find behavioral health support. It also includes contact information for providers and pharmacists to submit claims. Do your best not to lose your card, as it can potentially be a headache, especially if you need medical care while you're waiting to get a new card.

Most health care providers will ask to see proof of insurance before they will see you. After going through, one can get a pretty straightforward idea about the health insurance cards. I think that it is a good idea to maintain an effective health insurance coverage. I think that the cards should also link the patient's previous medical history. Most health insurance cards contain straightforward identification information about the people covered and the policy you have. To find out if a provider is "in network" contact your insurance company.

The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website.

Your online account is a powerful tool for managing every aspect of your health insurance plan. Whether you need to check on a claim, pay a bill, or talk to a representative, you can easily access all your member features. The back of the member ID card includes the member website and phone numbers to connect with customer service, speak with a nurse and discuss behavioral health. It also includes contact information for providers and pharmacists to submit insurance claims. Depending on your insurance plan, these numbers may be listed as a specific flat amount or a percentage of what the whole cost of the service will be. Sometimes, if you have a specific plan such as an HMO, which require you to see in-network providers, there will be two amounts listed on the card for each service.

Different insurance plans sometimes cover different pharmacy networks. For example, CDPHP employer plans use a Premier network; CDPHP individual plans use a Value network; and CDPHP plans for seniors use the Medicare network. Health benefits and health insurance plans contain exclusions and limitations.

Diagrams in the "Sample ID Cards" section of this chapter show how to quickly locate key coverage details and contact information. In some cases your ID number will change, such as if you switch health insurance plans during open enrollment. But, your number should stay the same if your plan doesn't change. If you are unsure of whether your ID number has changed, call Customer Service at the number listed on your ID card. Your BCBS ID card has your member number, and in some cases, your employer group number. Your member number, also known as your identification number, is listed directly below your name.

You'll need this information when receiving medical services at the doctor or pharmacy, or when calling customer service for assistance. If your group number is available, you'll find it directly below your member number. Keep it in a safe, easily accessible place like your wallet.

Your card contains key information about your health insurance coverage that is required when you need care or pick up a prescription at the pharmacy. Keeping your card in a secure location will also help protect you from medical identity theft. Your insurance card should contain all of the information above. The "coverage amount" tells you how much of your treatment costs the insurance company will pay.

This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. You might see several percent amounts listed together. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care.

This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans. Our health benefit plans have exclusions and limitations and terms under which the coverage may be continued in force or discontinued. For costs and complete details of the coverage, refer to the plan document or call or write Humana, or your Humana insurance agent or broker.

In the event of any disagreement between this communication and the plan document, the plan document will control. Ost people carry their health insurance cards in their wallets or purse. Your policy number on your health insurance card will not be the same as your group number. The policy number on health insurance refers to your individual member number, but the group number is different. Normally, your group number refers to your employer or where you get your insurance coverage from. If you lose your health insurance card, contact your health insurance provider immediately and inform them.

They will issue you a new card, which may have a new member ID or other different information on it. They will also likely cancel your other ID information so that no one else can use your benefits. There are several other pieces of information that may be present on your health insurance card. Some of the basics include your name and the name of your insurance company, as well as a phone number to contact them at. We offer flexible group insurance plans for any size business.

Employers can choose from a variety of medical, pharmacy, dental, vision, life, and disability plans. Our phones, keys, driver's licenses, and credit cards are kept at our fingertips at all times. Those items are unique to each of us and provide access to the things we need.

When it comes to healthcare services, that item is your Blue Cross Blue Shield ID card. Your member ID number identifies you as a covered member of Blue Cross and Blue Shield of Texas. It's very important because it is how you access your benefits when you need care, much like a credit card lets you use your account to make purchases. Your member ID number connects you to your information in our systems, and is what providers use to make sure you are covered for a treatment or medicine when you seek care.

Your member ID card – like the example shown here – identifies you as a CareFirst member and shows important information about you and your covered benefits. Each family member on your plan should have a card with their name on it. Make sure to always present your ID card when receiving services. If you don't have your physical card, you can view it on your smartphone through My Account.

Our phones, keys, driver's licenses and credit cards are kept at our fingertips at all times. Those items are unique to each of us, and provide access to the things we need. If you're wonderingwhere to find your group number on your insurance card, that answer is that it usually will show on the front of your card. If it's not there, you may need to call the customer service number, but you also just might not have one if you're not receiving your coverage through your employer. We encourage you to reach out to your health plan's member services department so that they may assist you with specific questions about your ID card and benefits. If your plan includes benefits for prescription drugs, you will also find some information related to them on your health insurance ID card.

Every health insurance card should have the patient's name on it. If you have insurance through someone else, such as a parent, you might see that person's name on the card instead. The card might also include other information, such as your home address, but this depends on the insurance company. Your Military ID card should be used as your TRICARE For Life benefit card. Your Military ID is your insurance card and has all of the information that a provider needs to file a claim.

The DoD number, benefits number or sponsor's social security number can be used when a policy number is requested. If your group number is available, you'll find it directly below your member number. Your BCBS ID card has important contact information to help you reach your BCBS company.